The Single Strategy To Use For Cash For Houses Detroit

Table of ContentsThings about Detroit Home BuyersLittle Known Facts About Cash For Houses Detroit.What Does House Buyers Detroit Mi Mean?The Definitive Guide to We Buy Houses DetroitLittle Known Questions About We Buy Houses Detroit.The smart Trick of Cash For Houses Detroit That Nobody is Discussing

Some low-income citizens can certify for as much as 5% of the expense of their down settlement or closing expenses when requesting an unique funding program via the Texas Buyer Program - https://www.edocr.com/v/zjmna271/williefinkel48150/35119370812815914327263266405008669486216859n. The state of Texas additionally runs a homebuyer education program you can use to find out more regarding the procedure of obtaining a mortgage and maintaining up with housing and insurance coverage payments

This need matters only in the context of applying for new buyer programs; there are no legal requirements in the state of Texas to acquire a home. As long as you're able to protect financing and the house owner wants to offer you a residential property, you can acquire a home.

The 4-Minute Rule for Sell My House Fast Detroit

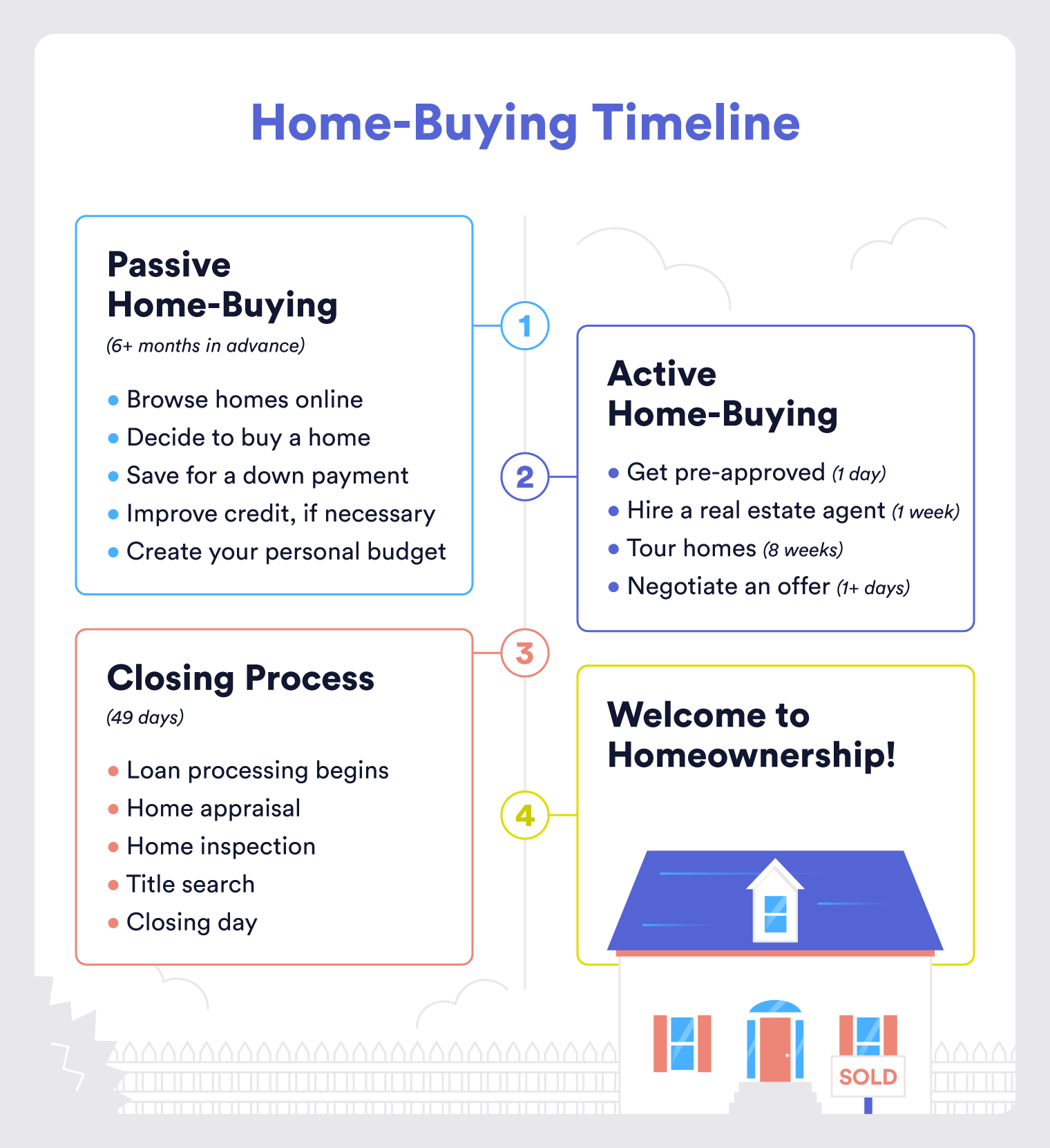

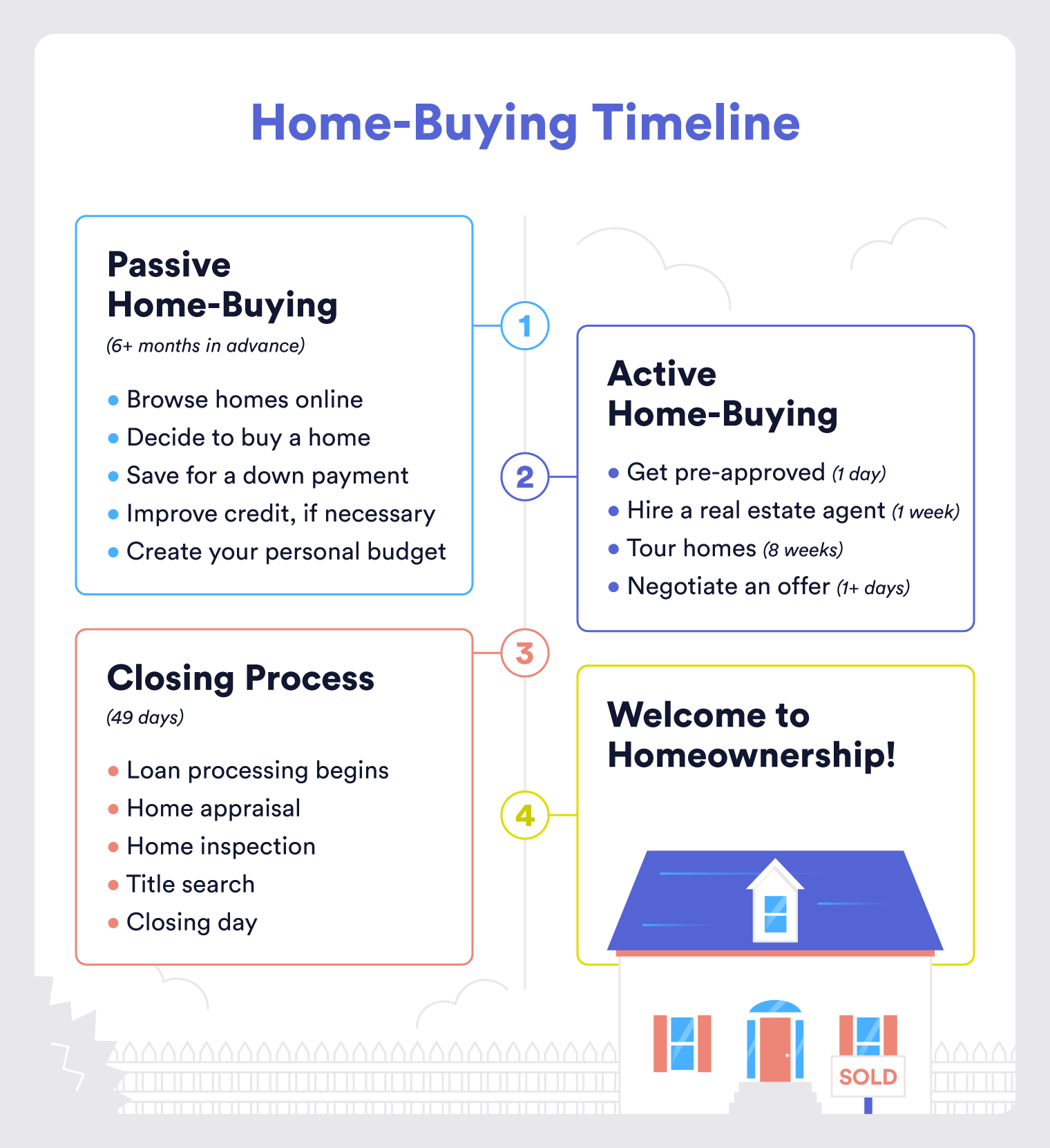

Ask yourself the following inquiries before choosing if currently is the most effective time to buy a home. Initially, think of your long-lasting objectives and exactly how possessing a home harmonizes your present phase of life - https://www.webtoolhub.com/profile.aspx?user=42370491. As an example, if you're worked out in your job and your current place really feels like an excellent lasting fit, seeking a mortgage may make feeling over renting out.

View how property rates are transforming over time and exactly how mortgage prices are changing., which differ in their qualification criteria and the residential properties you can purchase.

A home mortgage calculator includes major and interest, along with some expenses of homeownership that you might not have prepared for like mortgage insurance policy if you have less than 20% down at the time of acquisition. The following step after establishing a fundamental spending plan is to get preapproved for a home loan.

Sell My House Detroit Fundamentals Explained

Your pre-approval letter will give you a much more concrete, realistic budget. While the state of Texas does not provide independent deposit aid programs on a state degree, it does have a few funding programs readily available to make obtaining even more budget-friendly. This home mortgage program offers a 30-year government-backed mortgage with a more competitive webpage rates of interest compared to market rates.

This aid is provided as a grant or second home loan depending on income certifications. Individual cities in Texas might provide down repayment assistance.

The complexities of the realty market, coupled with the large array of options and legal details, can quickly bewilder even one of the most seasoned customers. sell your house for cash detroit. An experienced realty representative brings important proficiency to your home search, supplying a deep understanding of local market fads, areas, building values, and arrangement approaches

The Basic Principles Of Sell My House Detroit

, an associate of NAF, can assist you attach with genuine estate professionals in your location with individual concierge service. With your agent by your side, you can start the search for your desire home.

Your agent can have a look at the budget you're approved for in your pre-approval and advise locations and certain residences that fit your requirements. While you're free to explore on-line data sources to look for homes on the market, do not be terrified to ask your agent to create some choices for you.

Once you discover the appropriate home, it's time to make an offer. Your property representative can help you consider similar home sales, determine just how much to supply on the home, and submit an offer letter. While there isn't anything quiting you from creating your very own offer letter, realty agents recognize exactly how to include all the details that are required for a structured home sale.

Top Guidelines Of Sell Your House For Cash Detroit

During a home inspection, an inspector scenic tours your property. They will certainly check systems and produce a list of every little thing that needs to be fixed throughout the building (sell your house for cash detroit). While a home assessment isn't required like an assessment, it provides you essential insight right into the problem of the home you want to buy

Throughout closing, you will authorize your mortgage financing and take control of your new residential or commercial property. Make certain to evaluate your loan papers before closing and leave your lending institution with plenty of time to make corrections if you discover mistakes. One of the most significant advantages that you can take advantage of as a customer in Texas is the series of home mortgage loan choices readily available to you.

If you have solid credit score, you might certify for a reduced passion price on your loan.

The Best Strategy To Use For We Buy Houses Detroit

Closing assistance programs in Texas are sponsored by private cities there is not currently a statewide choice for Texas property buyers to gain access to closing expense aid. Locals purchasing a home in the city of Austin may qualify for up to $40,000 in down repayment and closing expense help when buying their very first home.